You are one “click” away from a million-dollar disaster.

Imagine a user in Tokyo attempting to navigate your new staking protocol. They intend to “Lock” their tokens to earn rewards, but due to a poor translation, the button reads “Close Account.” They panic, they exit, and your protocol loses a loyal user and their liquidity, forever.

In the high-stakes world of Decentralized Finance (DeFi), a simple mistake in your language isn’t just a typo; it is a critical security risk. If your users cannot understand your “Slippage” warnings or “Liquidation” rules in their own language, they won’t just be confused they will be gone.

DeFi is built on the core philosophy of “Don’t Trust, Verify.” But how can anyone verify a protocol they cannot even read?

When you expand into global markets, your project must speak the local language perfectly.

DeFi translation is about more than just changing words; it is about making sure your technical rules, financial math, and compliance disclaimers are crystal clear to everyone, everywhere. At Circle Translations, we help Web3 brands, from massive crypto exchanges to emerging DeFi startups, build trust by speaking the language of their users.

What is DeFi translation, and why does localization matter?

DeFi translation means taking your crypto ideas and changing them so people in other countries can understand them. It is much more than just swapping words from English to Spanish or Japanese. It is about making sure the meaning is 100% correct in every language.

Context vs. Literal Translation

In a normal business, if you translate a word slightly wrong, it might sound funny. In DeFi, if you translate a word wrong, someone might lose their life savings. Literal translations often fail to capture the financial intent behind the code.

- Swap vs. Trade: In DeFi, a “Swap” usually means using a pool of tokens to get a different one. A “Trade” sounds like an old-fashioned stock market. Using the wrong word can confuse users about how your tech really works.

- Gas vs. Fee: “Gas” is the specific cost of the computer power needed to move money on a network like Ethereum. If you just call it a “Fee,” users won’t understand why the price jumps when the network is busy.

- Staking vs. Saving: If you call staking “saving,” users might think their money is safe in a bank. They need to know that staking means “locking” their assets on the blockchain to help keep the network secure.

Localization matters because it removes the “friction of the unknown.” When a user in Korea or Brazil sees a dashboard that uses the right local words for “Liquidation Price,” they feel safe. If the words look like they came from a cheap translation tool, they will see it as a “red flag” and move their capital to a competitor.

Which DeFi content types must be localized?

A global DeFi brand needs more than just a translated homepage. Every part of the user journey must feel local to maintain the “trustless” experience that Web3 users demand:

- Dashboards & App UI: This is where the action happens. You need to localize real-time data, APR/APY numbers, and wallet balances to prevent user error during high-volatility events.

- Staking & Yield Farming: These are the most dangerous areas to get wrong. You need perfect instructions for locking and unlocking assets, as well as clear explanations of “Impermanent Loss.”

- Bridges & Rollups: Moving money between different blockchains (like Ethereum to Solana) is technically complex. Clear, local guides prevent users from sending their tokens to an incompatible “dead” address.

- Developer Documentation: If you want global developers to build on your protocol, they need to understand your “smart contract” rules and ABI documentation in their own language.

- Terms of Service & Risk Notices: These protect your team. If your “Risk Warning” or “Anti-Money Laundering (AML)” disclaimer isn’t clear in the local language, you could face severe legal trouble.

- Governance Proposals: If your project is a DAO (Decentralized Autonomous Organization), your members around the world need to understand exactly what they are voting for. A DAO is a group that is run by its members instead of a central leader or a boss. It uses rules written in computer code to make decisions and manage itself. When your documents are easy to read, it ensures that everyone can participate and their votes actually matter.

Where mistranslation creates user risk?

In DeFi, your words are as important as your code. There are five specific risk zones where a bad translation can cause a financial disaster for your users:

- Staking Rules: If you confuse “Unstake” with “Claim Rewards,” a user might accidentally pull their money out too early and lose their accumulated bonus or face an early-exit penalty.

- Bridging Money: This is the #1 way new users lose money. A confusing button on a cross-chain “bridge” can lead to tokens being sent to the wrong network, often making them unrecoverable.

- Liquidation Levels: Users must know exactly when their “loan” is in danger. If the “Health Factor” isn’t clear, they won’t know when to add more collateral to stay safe during a market dip.

- Slippage Warnings: Users need to understand that the price might change slightly before their trade finishes. If they don’t understand the “Slippage Tolerance” setting, they will feel cheated when they receive fewer tokens than expected.

- Gas Fees: If a user doesn’t understand the difference between “Standard,” “Fast,” and “Economy” gas, their transaction might get stuck in the mempool for hours or fail entirely during a network spike.

How DeFi translation actually works (The Workflow)

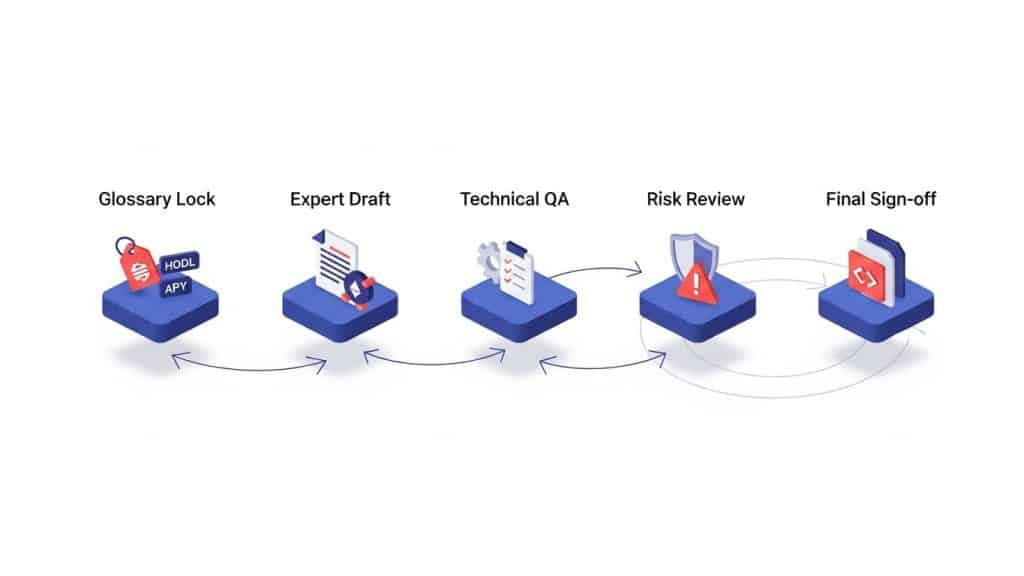

At Circle Translations, we don’t just “guess.” We use a 5-step workflow designed to keep your protocol’s users safe and your brand’s reputation intact:

- Step 1: The Word List (Glossary): We lock in your special terms (like HODL, Gas, APY, or LP) before we even start. This prevents “semantic drift” where terms change between your app and your docs.

- Step 2: The Expert Draft: A native speaker who actually uses crypto and DeFi protocols writes the first version. They understand the difference between a “Hard Fork” and a “Soft Fork.”

- Step 3: Technical Check: We use automated QA software to make sure the translator followed the approved word list perfectly and that all technical placeholders remain intact.

- Step 4: The Risk Review: A second senior expert, a crypto SME (Subject Matter Expert), checks every high-risk warning, financial number, and compliance disclaimer.

- Step 5: Final Sign-off: We check the final format (like JSON, Markdown, or Figma) so your developers can simply “plug it in” to your codebase without manual editing.

AI vs. Humans: When to use each?

Can you use AI for DeFi?

Yes, but only for the non-critical content. We use AI to help speed up things like educational blog posts or news updates to save you money.

But for your Smart Contracts, Governance, and Risk Warnings, we always use human experts. There is no room for an AI “glitch” or hallucination when millions of dollars in user funds are on the line.

The “Word List” (Glossary): The Backbone of Consistent UX

Consistency is the ultimate tool for building trust. If your app calls it a “Swap” on one page and a “Trade” on another, you will confuse your users. In the decentralized world, confusion often leads to fear, and fear leads to capital flight.

By maintaining a centralized “Word List” (Termbase) for your project, we help you reduce the number of help tickets and support burdens. When users see the same words used across the app, the website, the whitepaper, and the help guide, they learn your ecosystem faster. This is how you successfully scale from 1,000 users to 1,000,000 global participants.

Market Expansion: Regions Shaping DeFi Growth in 2026

DeFi adoption is growing fastest in regions where people do not speak English as their primary language. To capture real liquidity, you must target the markets where users are actively looking for decentralized alternatives:

- East Asia (China, Japan, Korea): These remain the world’s biggest hubs for high-volume crypto trading and exchange liquidity.

- Europe (Germany, France, UK): A major market for “serious” institutional DeFi projects and regulated “Green” crypto initiatives.

- Latin America (Brazil, Argentina): Users here frequently use crypto to save money, avoid high inflation, and access global financial markets.

- Turkey: Consistently one of the most active countries in the world for daily retail trading and peer-to-peer (P2P) transfers.

- Southeast Asia (Vietnam, Indonesia, Thailand): The heart of “Web3 gaming,” social-fi, and play-to-earn economies.

What changes in each country?

Localization is about cultural and regulatory tone. In Japan, users expect high levels of formality and very detailed “how-to” guides. In Korea, the focus is on a fast, clean, and ultra-responsive mobile experience. In Germany, technical precision and data privacy (GDPR) are what build trust with large institutional investors.

Deliverables you receive in a DeFi localisation project

We deliver more than just a list of words; we deliver a localized product that is ready for deployment. In a standard DeFi localization project, you receive:

- Ready-to-Use Files: We give you files in the exact format your developers use (like JSON, Markdown, Figma, or CSV).

- Your Master Word List: You get a full copy of every crypto and DeFi term we have localized for your brand for future use.

- The Revision Log: A detailed record of every edit and QA check we made so you have a complete audit trail.

- Design-Ready Exports: If you have PDF “Litepapers” or graphics, we return them fully designed and localized, ready for publication.

A Note for Developers: We don’t touch the code

We work directly with your code environment using tools like GitHub or GitLab connectors. But don’t worry, we only translate the “user-facing text” and the “developer comments.” We never touch the actual executable smart contract code that runs your protocol. We preserve the technical integrity of your logic while making it accessible to the world.

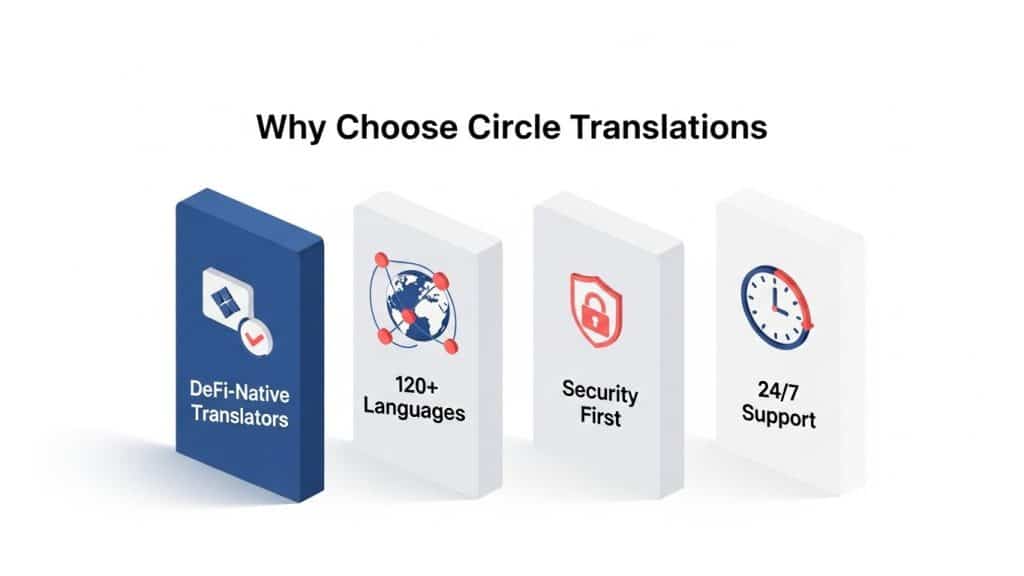

Why Choose Circle Translations for Your DeFi Brand?

In the fast-moving world of Web3, you need a partner that moves as fast as a 12-second block time. We offer:

- DeFi-Native Translators: Our team doesn’t just “know” about crypto; they are active stakers, yield farmers, and DAO voters themselves.

- 120+ Languages: We have the operational scale to take you from a local startup to a global market leader.

- Security First: We sign NDAs (non-disclosure agreements) before we even look at your files. Your “secret features” and unreleased tokenomics are safe with us.

- 24/7 Support: Crypto never sleeps, and neither do we. We work across every time zone to ensure your launch deadlines are met.

Proof Points that Matter to DeFi Teams

When you partner with us, we provide the specific operational guarantees that crypto teams need to stay agile:

- Turnaround SLAs: We understand that “Mainnet launches” and “Exchange listings” don’t wait. We provide guaranteed service level agreements to ensure your content is ready when your code is.

- Revision Cycles: Every project includes dedicated revision rounds to ensure the final “cultural fit” is perfect for your community.

- Glossary Ownership: You own 100% of your terminology assets. If you ever move your project, you take your “memory bank” with you.

- API Import/Export: We integrate directly into your technical stack, allowing for seamless content synchronization without manual handoffs.

- Privacy & NDA: Our process is NDA-first. Your protocol’s unreleased features, tokenomics, and security audit results are protected behind encrypted channels.

- Sprint Cycle Alignment: We align our delivery with your weekly sprint cycles. As your developers push new strings to the repository, our linguists provide translations in time for your next release.

Is your protocol truly ready for a global audience?

Don’t let a “simple” mistranslation drain your project’s liquidity or confuse your users. Upload your UI Strings or Get a Quote today, and let Circle Translations help you build a global DeFi brand that people can trust.

DeFi Translation — FAQs

What makes DeFi translation different from normal financial translation?

It is about the “crypto-native intent.” A normal financial translator might translate “Gas” as “petrol” or “fuel.” A DeFi expert knows it refers to transaction fees on a blockchain. We understand the unique math and incentive models behind your protocol.

Do you translate the smart contract code itself?

No. We translate the “UI strings” (the buttons and menus), the documentation, and the comments. Your executable code stays 100% the same to ensure it remains secure and audited.

How do you keep the numbers accurate for APY and fees?

We use a Glossary-First approach and have two experts check every financial term. For high-risk data like liquidation prices or fees, we only use human experts, never raw, unreviewed AI.

Which languages should we prioritize for a DeFi launch?

If you are looking for institutional liquidity, start with Chinese, Japanese, and Korean. If you want high retail adoption and wallet users, Spanish and Turkish are the best choices right now.

Can AI save us money in DeFi localization?

Yes! We use AI to speed up the “informational” content like blog posts and news updates. This can save you up to 40% on those specific parts of your project while keeping your budget focused on high-risk UI translation.